Empowering innovation

We partner with visionary leaders of technology

companies to accelerate their next phase of growth

Portfolio

highlights

Infrastructure Software

Arctic Wolf

The founding of Arctic Wolf with Brian NeSmith

CxO Software

Expensify

Intention, patience, and discipline: how Expensify became a category defining company

Vertical Software

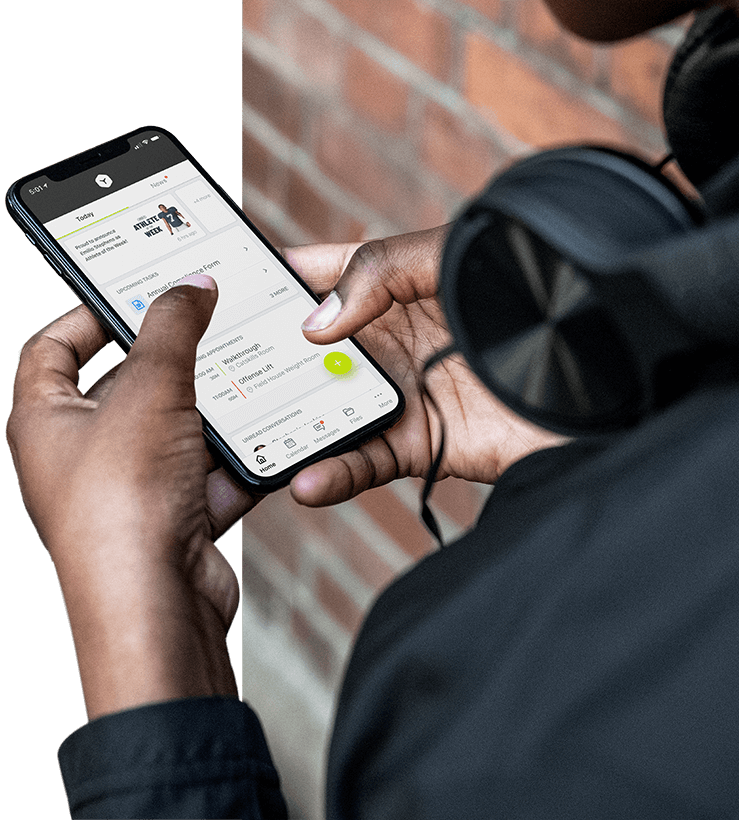

Teamworks

How Teamworks is executing the Vertical SaaS playbook

Cloud Services

OSF Digital

Scaling to 2,000 global employees with OSF's Gerry Szatvanyi

At a glance

We’ve been providing flexible growth capital solutions to innovative companies in infrastructure software, cloud services, CxO software, and vertical software for more than a decade.

Assets under management

Investments

Year Founded

M&A add-ons

Who we are

As former operators and engineers, we help leaders scale their businesses and realize potential.

Get to know the Delta-v team and the unique insights and perspectives we bring to our investments.